Environmental, social and governance (ESG) topics have received considerable attention over the past years, being largely driven by investors seeking to understand the risks and opportunities that could impact financial performance. In addition, stakeholders including customers and employees are holding companies up to higher standards, using ESG data to evaluate a company’s performance on topics they personally find important. This can include the diversity of the workforce or the company’s efforts in reducing its environmental footprint. In the absence of regulation and a growing market demand for transparency in sustainability-related data, an overflow of voluntary ESG reporting standards and frameworks have emerged. Currently hundreds of these frameworks and standards exist creating a lot of noise and confusion for the individuals that have to navigate this landscape. Therefore, we aim to provide some clarity the different ESG standards and frameworks that currently exist and how this landscape is changing.

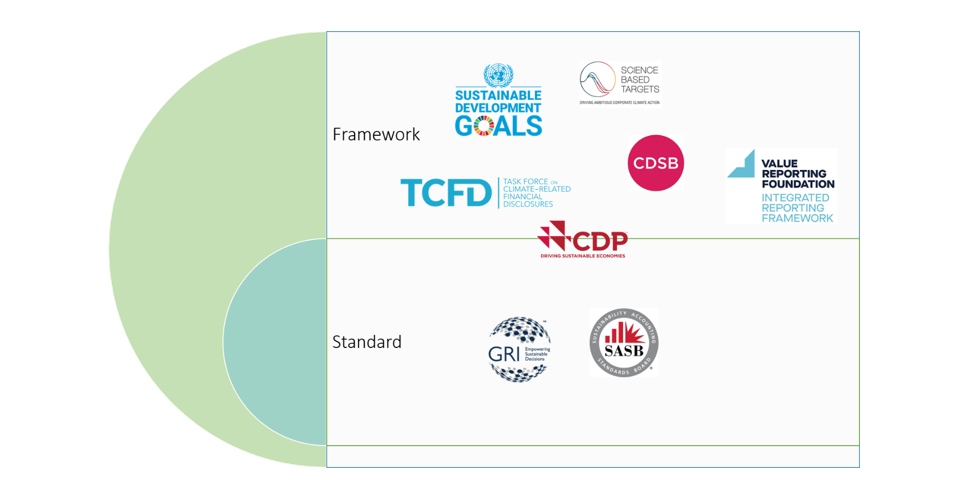

It is important to first know the difference between a standard and a framework. A framework such as the Sustainable Development Goals (SDGs) provide a reference for companies on sustainability but leave room for interpretation in the direction a company may want to go. Thus, frameworks do not provide any metrics or reporting obligations. A standard like the Global Reporting Initiative (GRI) makes a framework actionable and contains detailed information including specific criteria and metrics which outline exactly what a company should report on for each topic. The figure below gives an overview on of the most common frameworks and standards.

Key ESG Frameworks

The Sustainable Development Goals

Task Force for Climate-Related Financial Disclosures

Integrated Reporting Framework

Science Based Targets Initiative

The Climate Disclosure Standards Board (CDSB)

Key ESG Standards

Global Reporting Initiative (GRI)

Sustainability Accounting Standards Board (SASB)

The Carbon Disclosure Project (CDP

A Migrating Landscape

While each framework and standard have a different purpose and caters to a different audience, there is still a lot of overlap between them. Shareholders also saw this and have started pushing to consolidate the landscape and create some sort of consensus on sustainability reporting.

So, what is happening?

First, we have the International Financial Reporting Standards (IFRS), the organization responsible for developing a cohesive global accounting standard. This organization has also taken it upon themselves to develop a global baseline for corporate sustainability disclosure in what will be known as the International Sustainability Standards Board (ISSB). Do you remember SASB and IIRC merging in 2021 to create the Value Reporting Foundation? Well, as of June 2022 the Value Reporting Framework together with the CDSB will be merging into the IFRS to help develop the ISSB. Finally, the TCFD and GRI have entered into collaborative agreements with the ISSB to help draft the disclosure standards.

Next, we have the European Union who in their quest to become the first climate neutral continent by 2050 has developed the European Green Deal. Part of this deal includes the Corporate Sustainability Reporting Directive (CSRD). As stated by the European Union (2021), “the goal of the CSRD is to ensure that companies report reliable and comparable sustainability information needed by investors and other stakeholders. That would facilitate a consistent flow of sustainability information through the financial system.” Essentially, large companies will be required in 2024 to disclose sustainability information in the same rigor as with financial disclosures. The European Financial Reporting Advisory Group (EFRAG) has been tasked with developing the reporting standards. Again, the GRI and TCFD will be consulting with EFRAG during the development of the standards. Further both the IFRS and EFRAG have made bilateral agreements to consult each other in the development of the different standards.

Sources:

https://www.europarl.europa.eu/legislative-train/theme-a-european-green-deal/file-review-of-the-non-financial-reporting-directive#:~:text=Overall%2C%20the%20proposal%20aims%20to,information%20through%20the%20financial%20system.

creating momentum, delivering results.

- EMEA, +31657765304 I Americas, +1 7048072152

- office@sustainability360.ai

- www.sustainability360.ai

- All Rights Reserved © 2022

creating momentum, delivering results.

©2022 Sustainability360. All rights reserved.